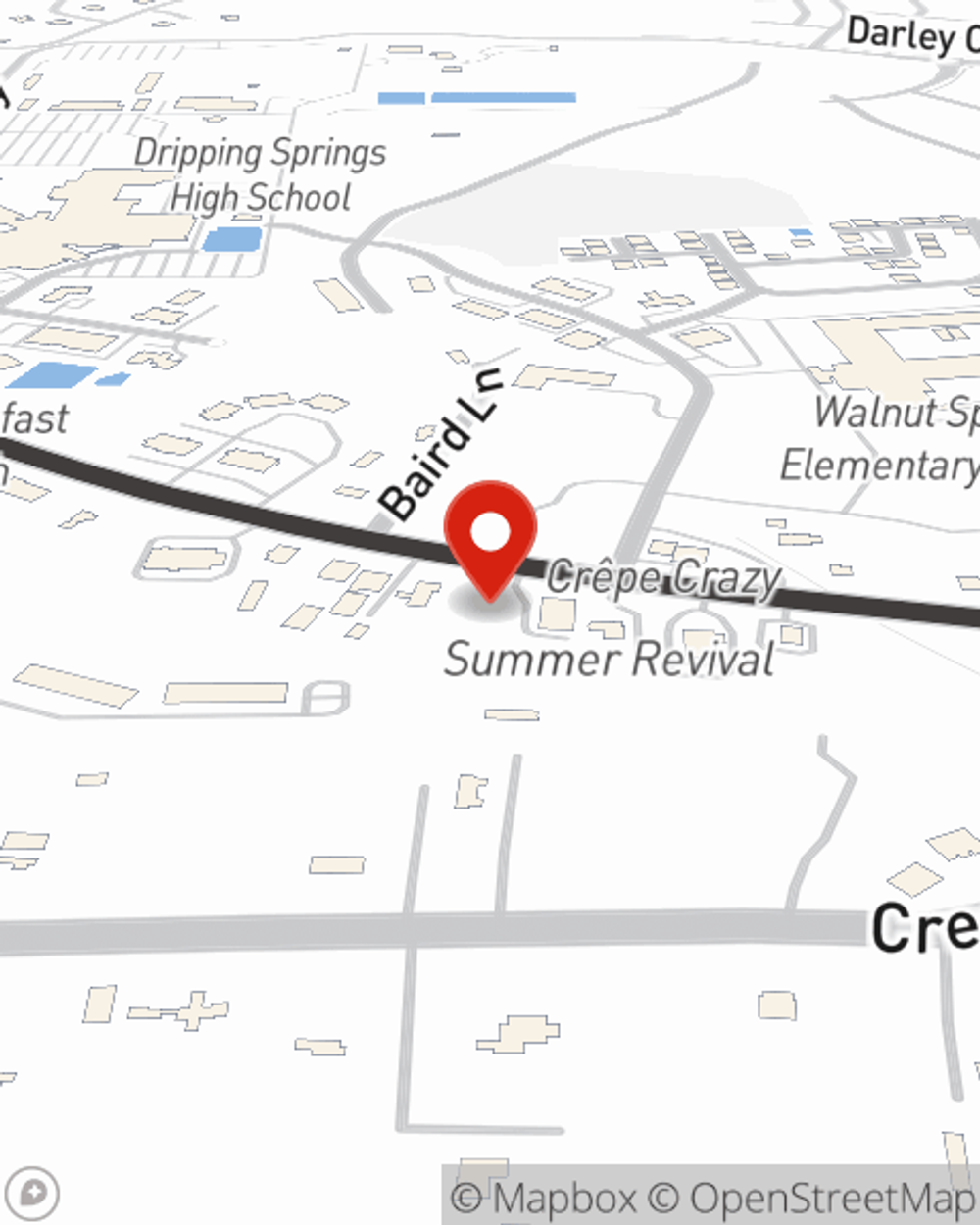

Life Insurance in and around Dripping Springs

Get insured for what matters to you

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- Dripping Springs

- Austin

- Johnson City

- Blanco

- Wimberley

- Driftwood

- Lakeway

- Bee Caves

Be There For Your Loved Ones

State Farm understands your desire to care for your family after you pass away. That's why we offer wonderful Life insurance coverage options and compassionate considerate service to help you choose a policy that fits your needs.

Get insured for what matters to you

Life won't wait. Neither should you.

Put Those Worries To Rest

But what coverage do you need, considering your situation and your loved ones? First, the type and amount of insurance you select should align with your current and future needs. Then you can consider the cost of a policy, which depends on how old you are and how healthy you are. Other factors that may be considered include body weight and family medical history. State Farm Agent Mark Handley can walk you through all these options and can help you determine what type of policy is appropriate.

To experience your Life insurance options with State Farm, get in touch with Mark Handley's office today!

Have More Questions About Life Insurance?

Call Mark at (512) 894-4470 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Mark Handley

State Farm® Insurance AgentSimple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.